Three Retirement Savings Lessons for Young Investors

For those at the earlier stages of their professional career, retirement might seem like a myth - something too distant to think seriously about. The reality, as you are probably well aware is, the sooner you start to prepare, the more enjoyable and fulfilling your retirement is likely to be.

When speaking with younger clients, an efficient way to start a conversation about retirement savings is to ask them what their ideal retirement would look like. How old would they be? Would they no longer have to work? And if not, what else could they picture themselves doing? A little bit of creative visualization can be a powerful way to get them engaged and motivated.

The next thing you might want to do is walk them through some of the most important lessons that can help them make their retirement vision come true.

Lesson #1: Start early

Investing isn’t magic, but there is one aspect of investing that does have near-magical qualities, and that is the power of compounding. The simplest way to understand compounding is to think of it as making money, and then using the money you made to make even more money.

This is referred to as compound growth, and the longer your money is able to compound, the more that growth can accelerate. Imagine this: if you invest $1,000 and it grows by 8%, you’ll make $80. But when your portfolio is worth $100,000, that same 8% return will make you $8,000. And with a $1 million portfolio, you’ll make $80,000.

Now let’s apply the power of compounding to two retirement savings scenarios:

- Suzy started saving $300 per month at age 25 and earned an 8% annual return. At age 65, she will have accumulated approximately $1,054,284.37.

- Alex also started saving $300 per month and earned the same 8% annual return, but he didn’t start until age 35. At age 65, he will have accumulated only $450,088.55.

Thanks to the power of compounding, Suzy started just 10 years sooner and ended up with more than twice as much money. The lesson: Start saving for retirement as soon as possible.

Lesson #2: Maximize time in the market

One reason to delay investing is because you feel it’s not a good time. For example, you might worry that there’s a recession coming, or an election taking place, or that the market is too high.

But history has shown that the best time to invest in the market is always now. Even if something negative happens in the future - and it almost certainly will - the investment growth you could miss out on accumulating between now and then will be gone forever. Remember the fact that lost time for compound growth can never be recaptured (see Lesson #1 above).

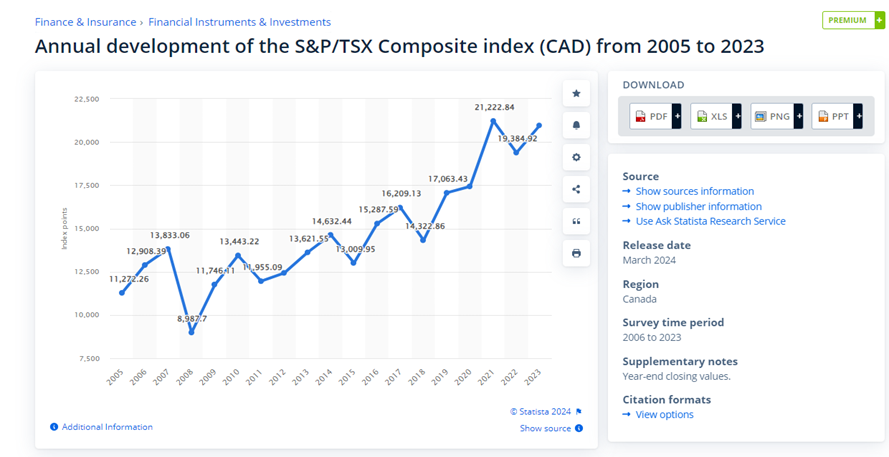

Perhaps the simplest way to illustrate this point is with a picture1. Below is a snapshot of the S&P/TSX Composite index, which shows the performance of the Canadian stock market from 2005 to the present, nearly two decades. Despite frequent market downturns resulting from recessions, elections, wars and even the global pandemic, the long-term trend of the market has always remained upwards. The same holds true for other major markets, such as the S&P 500 in the U.S.

Despite their best efforts, not even the experts on Bay Street and Wall Street have been able to demonstrate the ability to consistently time the market and avoid negative events. Rather, what matters is staying invested over a long time frame so you can benefit from the overall upward trend.

The lesson: Retirement savings are not created by timing the market, but by maximizing the amount of time you are invested in the market.

Lesson #3: Avoid harmful myths

Even when younger investors embrace the potential to earn compound growth in the market, there are several myths that can prevent them from taking action on their retirement savings. Here are some common myths and ways that you can respond:

"I don't make enough to save for retirement."

Many think that if they’re not earning a lot, they can’t afford to save for retirement. However, even small contributions made consistently can add up over time, especially when that money is invested in the market and allowed to grow.

"I'll save more later when I make more."

While earning more can help, there are two major flaws in this approach. First, most people who earn more also spend more, making it just as hard to save. And second, as we’ve seen, time is the most crucial element of compound investment growth, and once it’s gone, it’s gone.

"Pensions will cover my needs."

Pensions are typically designed to be a supplement, not a primary source of income, and there is always uncertainty about the amount and availability of these benefits far into the future. It’s much safer to have your own source of financial security in retirement.

"Investing is too risky."

While all investments have risks, deciding not to invest or keeping all your money in savings accounts or other low-yield vehicles poses an even greater risk: the risk that you will not be able to accumulate enough wealth to make your retirement vision a reality.

Motivating young clients to take retirement savings seriously is one of the more difficult tasks for a financial advisor, but also one of the most valuable. Few other interventions can have such a major positive impact over the course of their lives. And when you need investment solutions to support your advice, you can count on Beneva to be there for you.