TFSA Tax-free earnings. Withdrawals anytime you like.

Tap into performance-focused investment products.

Financial goals

Savings

Horizon

Variable

Or give us a call

1 866 612-3473

The Tax-Free Savings Account is a registered account to which you can contribute a given amount every year without ever being taxed on your earnings.

It's an excellent short- to medium-term strategy to reach financial goals or to optimize your savings and build a nest egg. The best part, you can withdraw your money as you see fit and never pay a dime in taxes.

Why opt for the TFSA?

Smart, flexible savings that pay off

How does it work? TFSA: Investing in 4 easy steps

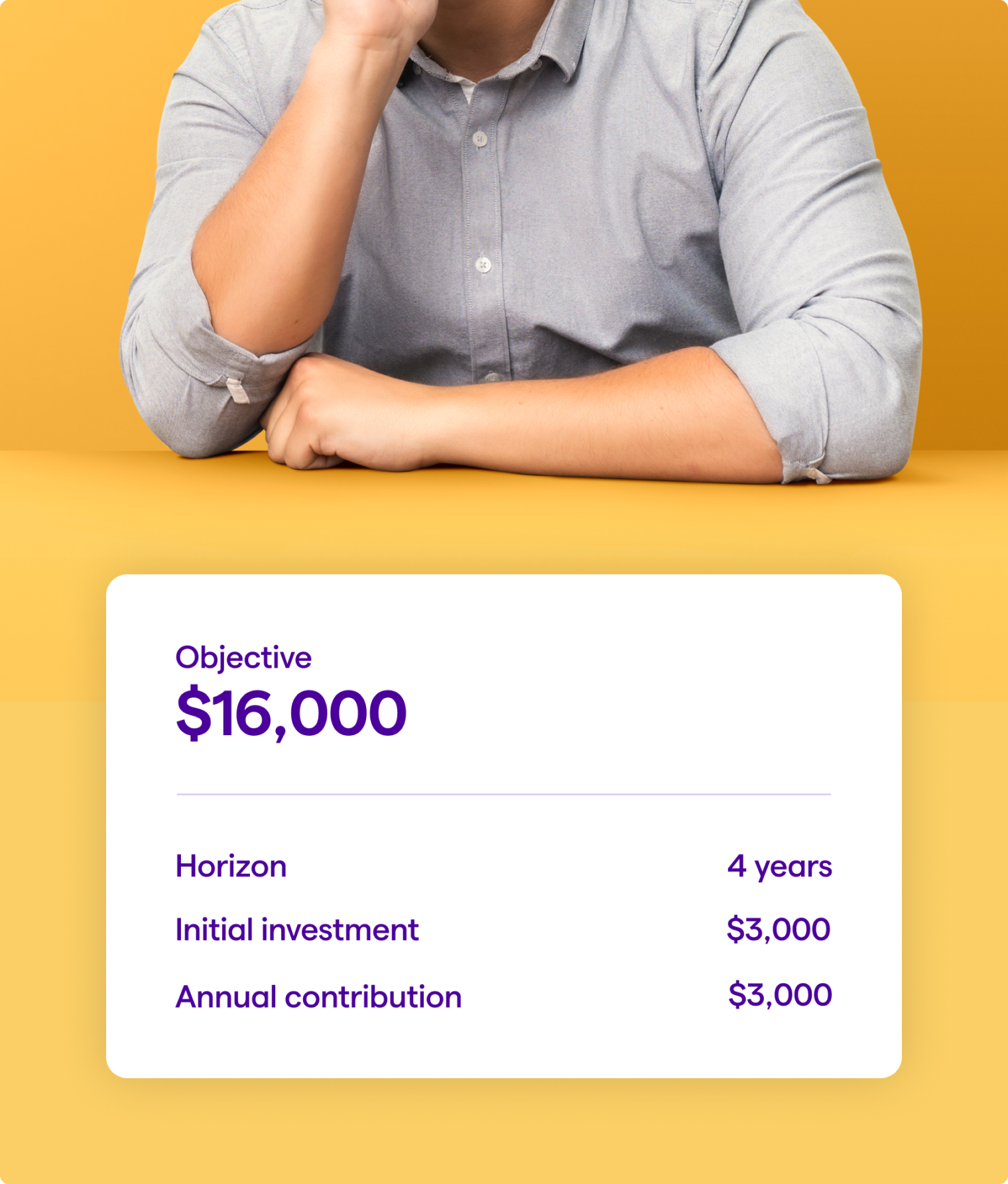

1. It all starts with a plan

One of our advisors helps you map out an investment plan to reach your financial goal, including: investment horizon, the amount and frequency of your contributions, your risk profile and, finally, the right investments for a winning strategy.1

Learn more about risk profiles

2. Add to your TFSA

Follow your contribution plan or add an extra lump sum here and there, as long as you don’t exceed your TFSA contribution limit.

Pro tip: Set up automatic deposits to stay on track hassle-free.

3. Let your money do the work

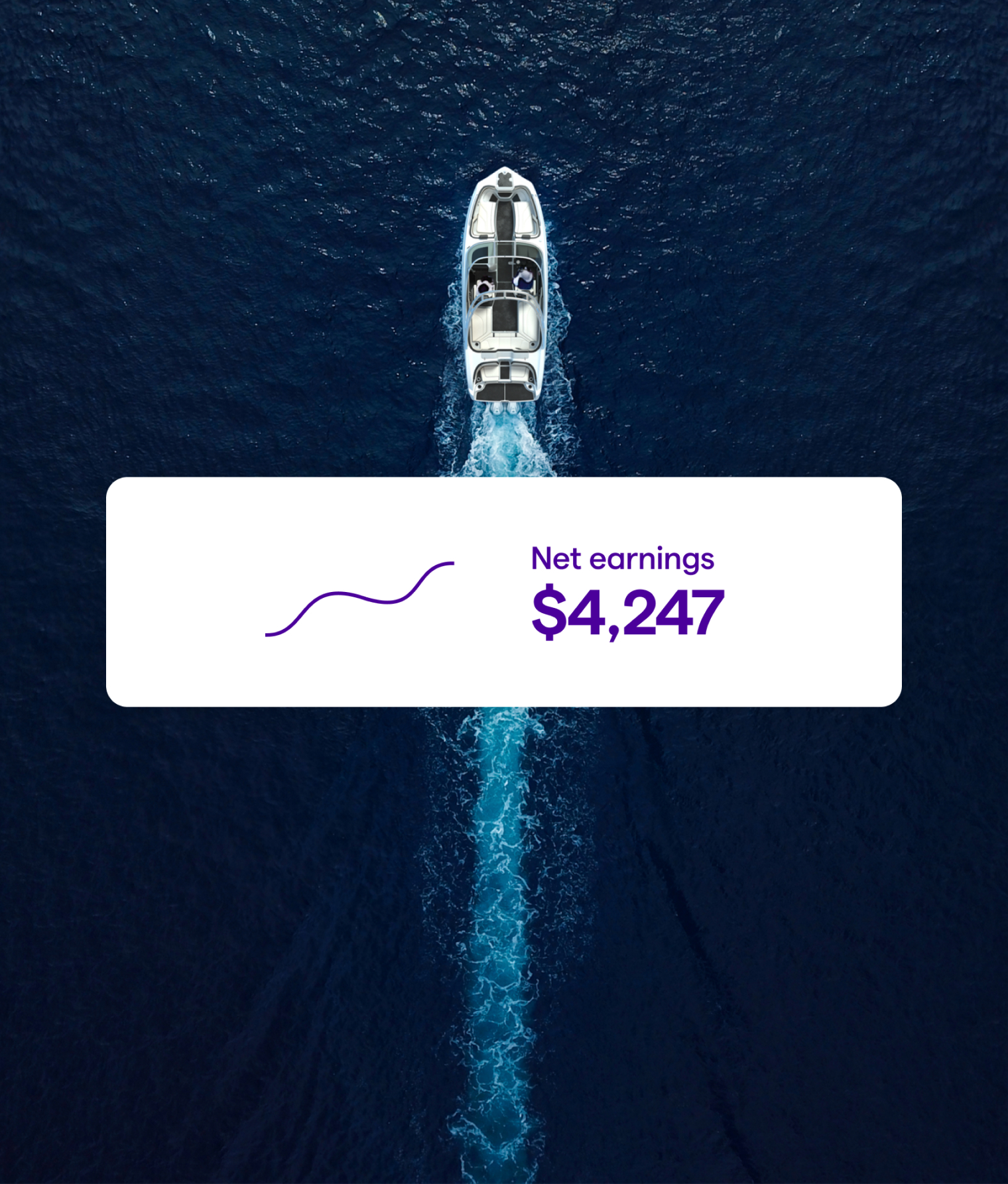

Your earnings are tax-sheltered, and you benefit from growing income thanks to compound interest.

4. Withdraw whenever you like

The best part about the TFSA is the freedom to withdraw at any time without tax penalties. Simply cash in whenever you’re ready to kick off your project!

The scenario shown here is for demonstration purposes only and should not be relied upon as financial or other advice.2

Beneva, a smart investment

TFSA contribution limits

Every year, the Canada Revenue Agency sets a TFSA contribution limit. It carries over from year to year and adds up to establish cumulative contribution room.

$7,000

Maximum amount for 2025

$102,000

Cumulative maximum amount

Think of the TFSA as an empty box. How you fill it is up to you!

More questions? Sign up for our webinars.

Take control of your financial future. Sign up for one of our financial security webinars and get clear, useful and practical information to use in your current situation.