Or give us a call

1 866 612-3473

A Locked-in Retirement Account (LIRA) is a type of registered pension fund used to hold your pension savings with a former employer. Even if you can’t continue to save with a LIRA, you can still manage your investments to reflect your retirement goals.

Why open a LIRA?

Sheltered today.

Pays off tomorrow.

How does it work? LIRA: Investing in 4 easy steps

1. It all starts with a migration plan

If you have a pension fund with a former employer or a LIF that you would like to lock-in again, that’s your cue to get in touch with one of our advisors about a LIRA.1

Together, we map out a plan for the retirement you want based on the funds you have in your LIRA, including investment horizon and your risk profile.

2. Next comes strategy

A specific feature of the LIRA is that you cannot contribute to it over the years. But, unlike a pension, you control 100% of your investments and you can change them as your needs change.

3. Let your money do the work

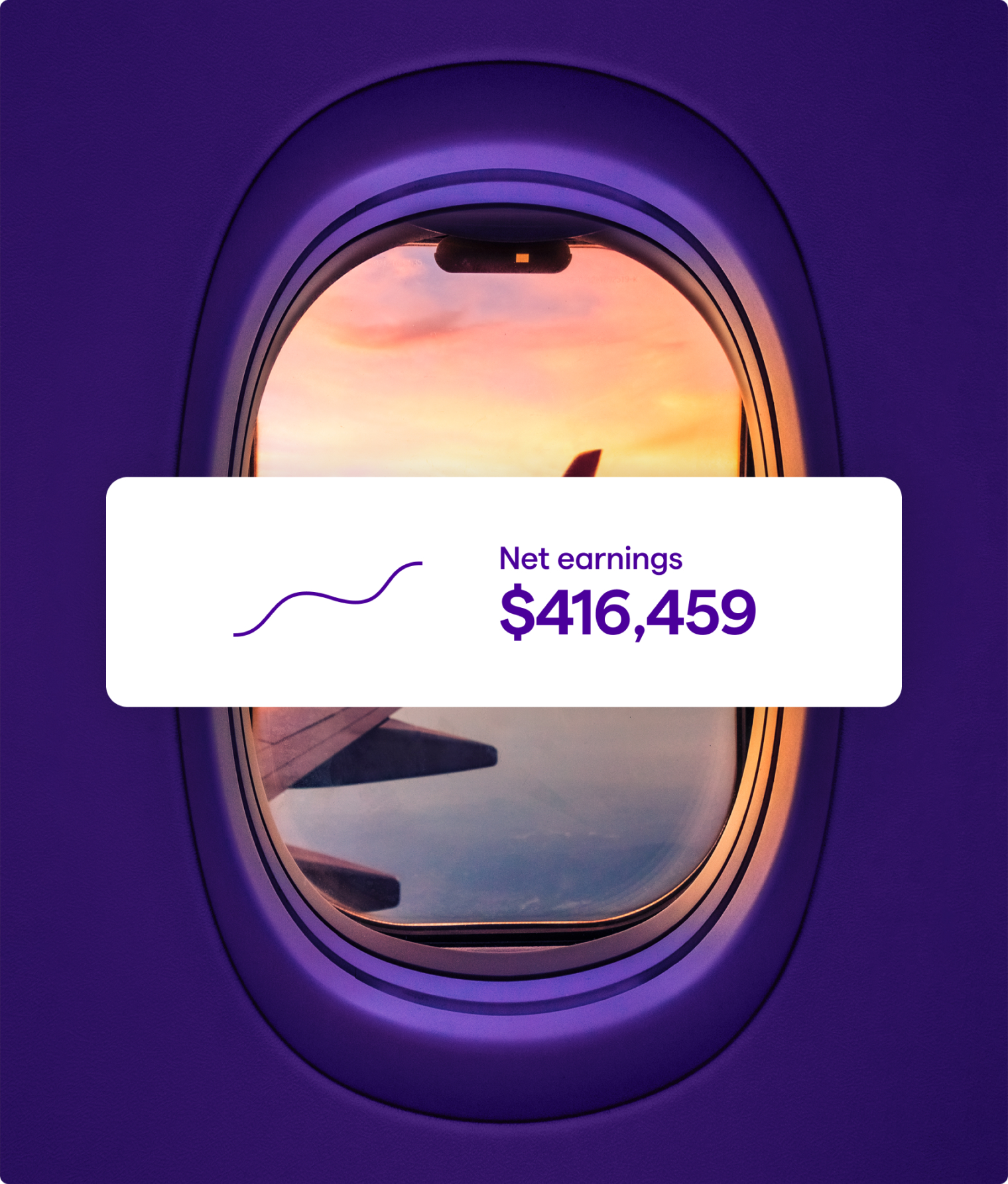

You can't withdraw early from a LIRA, save for specific exceptions. This makes it perfect for discipline. Watch your investment earnings grow tax-sheltered until withdrawn. With this account, you’re playing the long game for the win!

4. Switch plans to receive retirement income

You can’t technically withdraw from your LIRA, you first have to move your money to a LIF or annuity to receive payments.

In all cases, whether retired or not, and regardless of the maturity of the investments, this transfer must take place before the end of the year you turn 71.

The scenario shown here is for demonstration purposes only and should not be relied upon as financial or other advice.2

Beneva, a smart investment

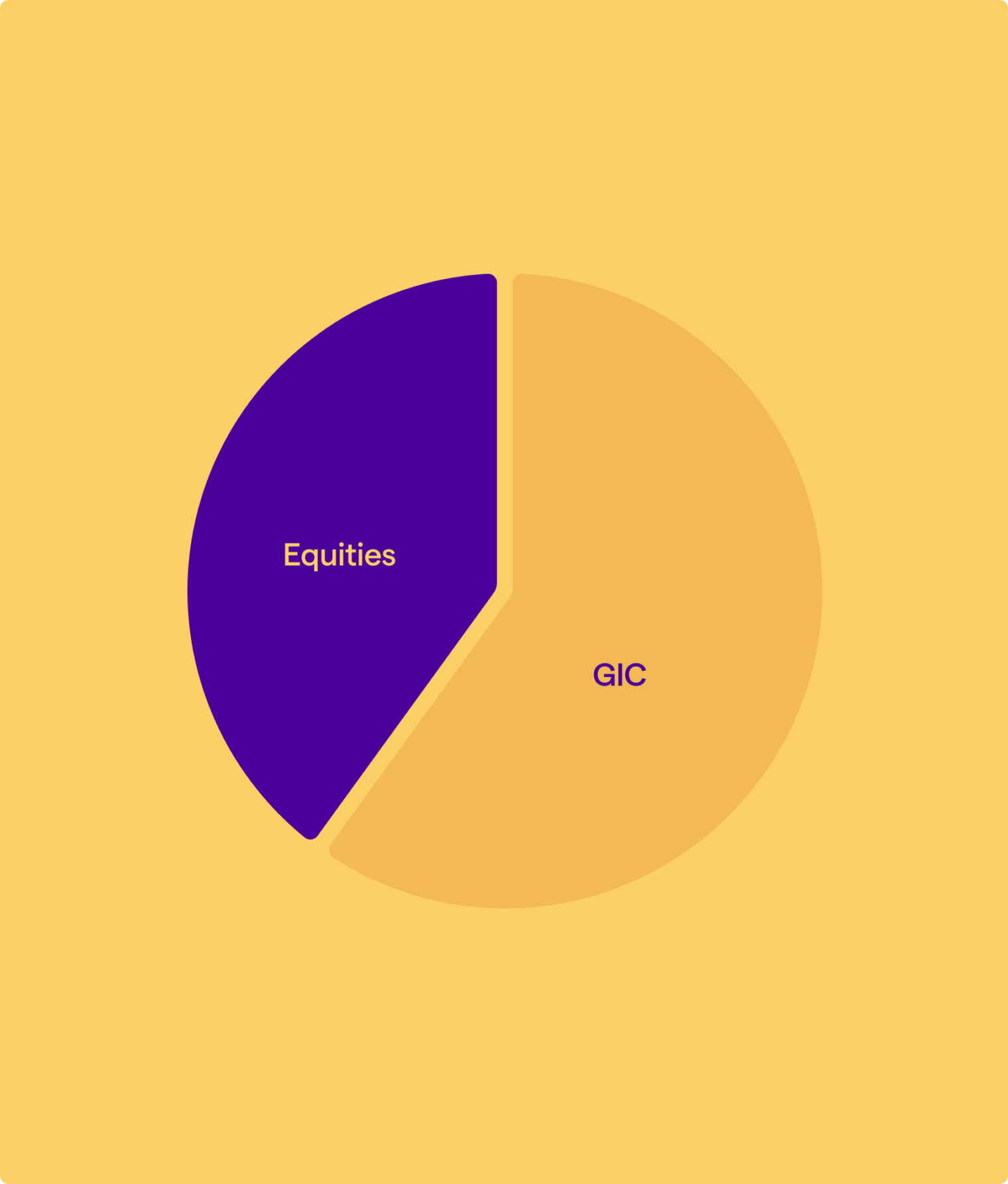

Think of the LIRA as an empty box. How you fill it is up to you!

You might like these plans too

1. On behalf of Beneva Inc., Financial services firm and its authorized partners.

2. The risk profile is balanced based on the needs analysis completed by the advisor.1 The scenario is based on a 25-year horizon, with the reinvestment of earnings and a 4% annual return rate.