RRSP Plan your retirement. Pay less taxes.

Financial goals

Retirement

Education

Home

Horizon

Long-term

Or give us a call at

1 866 612-3473

The Registered Retirement Savings Plan (RRSP) is a federal plan that allows you to save for retirement, a first home or a return to school—while lowering your annual taxes. No wonder over 60% of Canadians have one!

Why open an RRSP?

Less taxes today.

More income tomorrow.How does it work? RRSP: Investing in 4 easy steps

1. It all starts with a plan

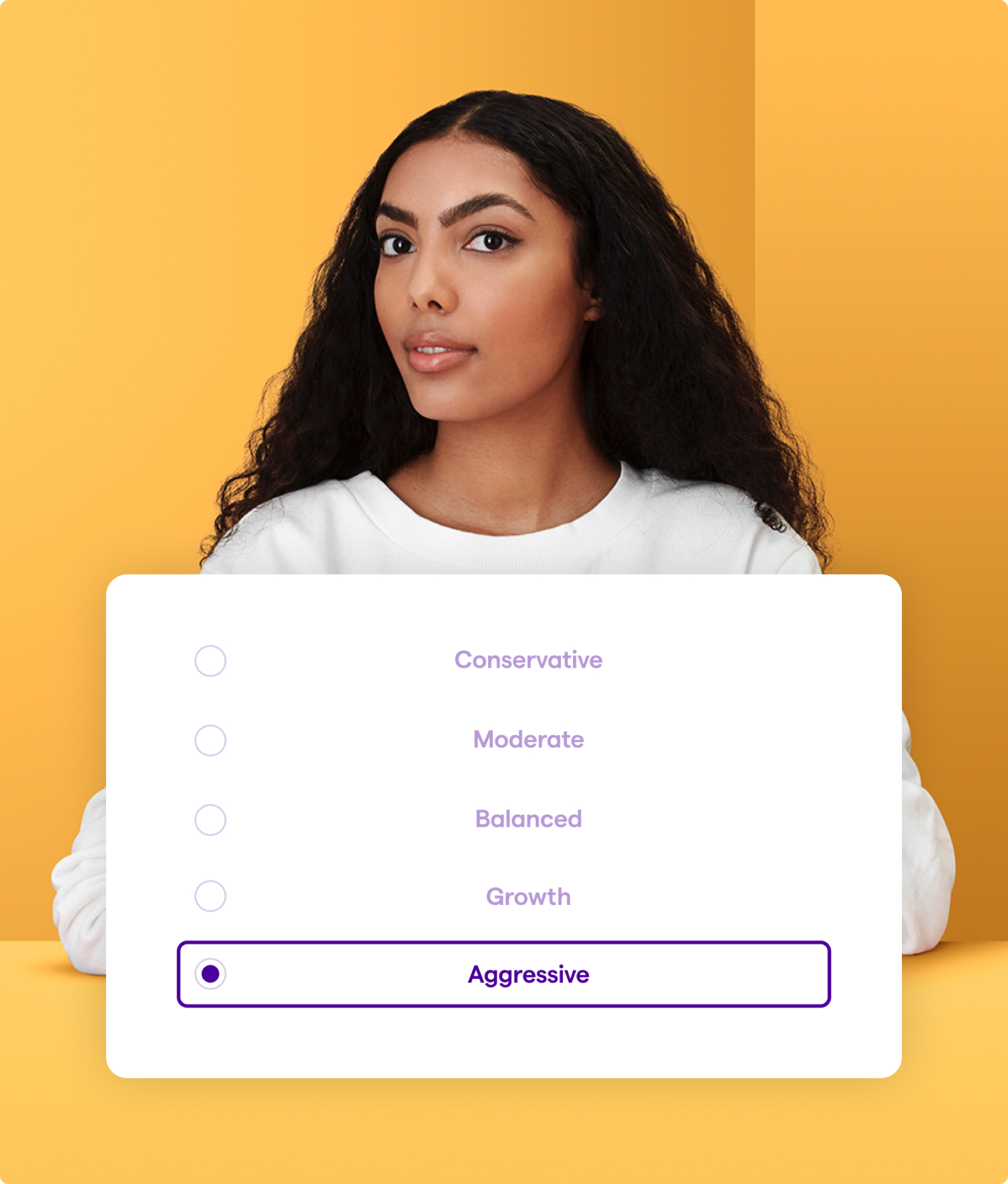

One of our advisors2 helps you map out an investment plan for the retirement you want, including: investment horizon, the amount and frequency of your contributions, your risk profile and, finally, the right investments for a winning strategy.

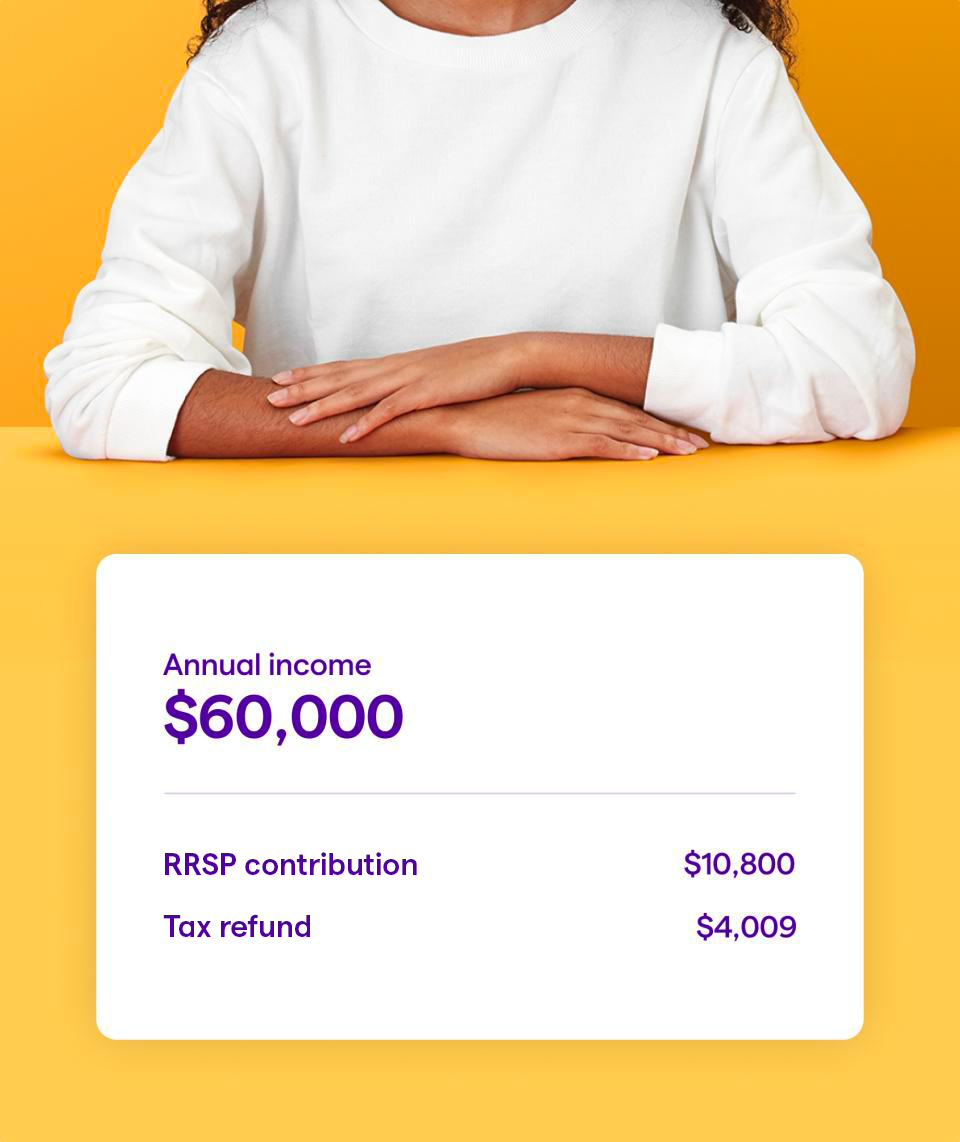

2. Contribute what you can each year

The maximum annual contribution is generally 18% of your taxable income or $32,490 (in 2025). This contribution is then deducted from your taxable income.

Didn't maximize your RRSP this year to keep a safety cushion? No worries, your unused contribution room will simply add up.

3. Let your money do the work

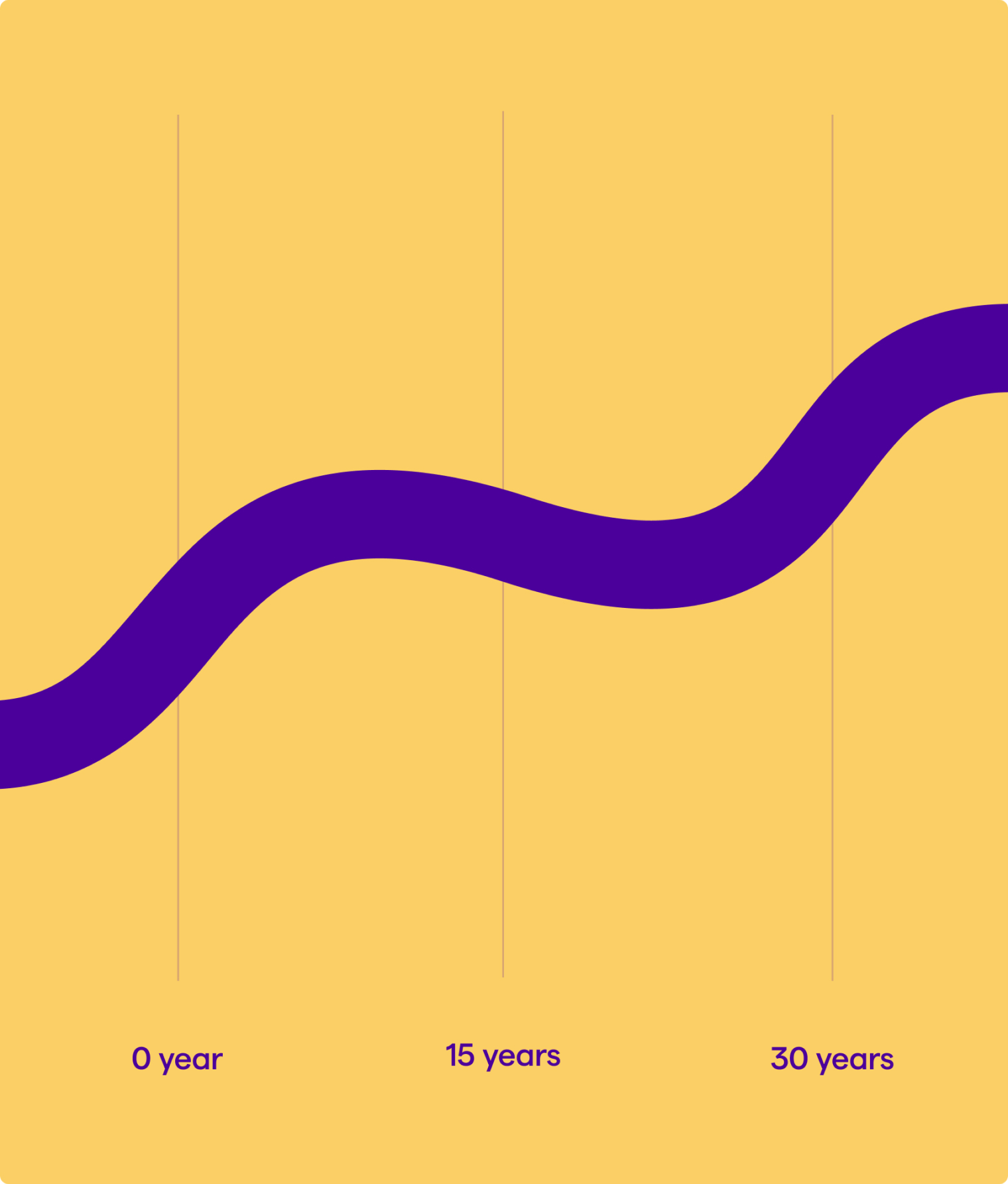

Your earnings are tax-sheltered, and you benefit from growing income thanks to compound interest.

4. Withdraw for retirement, a first home or a return to school

At retirement or before the end of the year you turn 71, transfer your RRSP to a RRIF or an annuity to set yourself up for retirement and finally enjoy it!

You can also withdraw up to $60,000 before retirement to help buy your first home (HBP) or pay for your education (LLP).

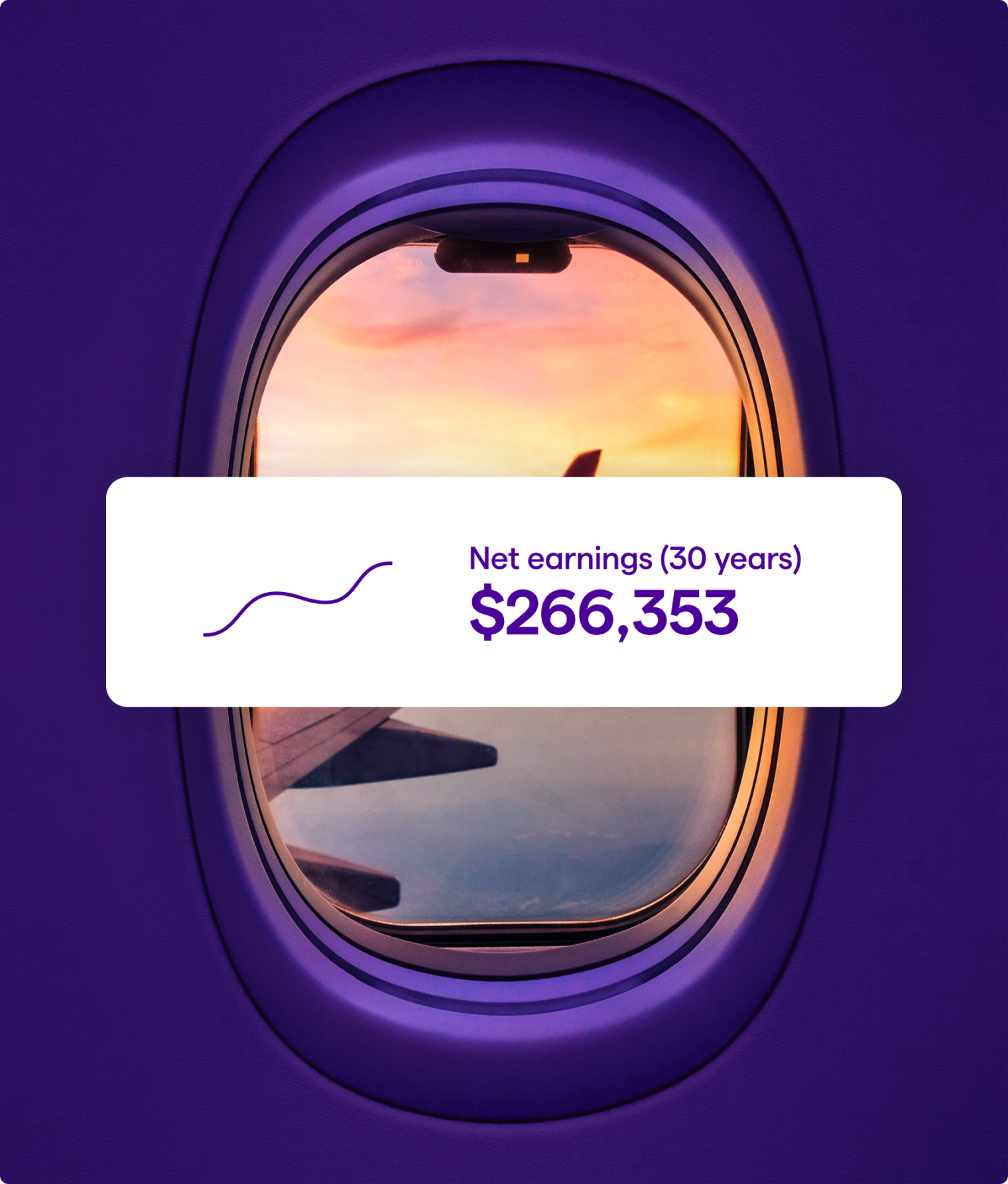

The scenario shown here is for demonstration purposes only3 and should not be relied upon as financial or other advice.

Beneva, a smart investment!

Automatic savings

Not one to squirrel money away? Go automatic for quick, easy savings!

Let's face it: we all mean to save, but often don’t. So we've made it easy for you to contribute to your RRSPs with Beneva's payroll deduction5 and pre-authorized debit plan.

That's what we call automatic savings: just set it and forget it! And the best part, you get a better return with steady deposits. Talk to your advisor2 about getting started.

Think of the RRSP as an empty box. How you fill it is up to you.

More questions? Sign up for our webinars.

Take control of your financial future. Sign up for one of our financial security webinars and get clear, useful and practical information to use in your current situation.

These plans might also interest you

1. Some conditions apply.

2. On behalf of Beneva Inc., Financial services firm and its authorized partners.

3. The initial risk profile is aggressive and changes to balanced based on the needs analysis completed by the advisor2. The scenario is based on a 30-year horizon with a starting salary of $60,000, the maximum allowable contribution, an estimated salary increase of 2.5%, no reinvestment of tax returns but reinvestment of earnings, and an annual return decreasing from 6% to 4%, and then to 2% to reflect the changed risk profile.

4. Participating employers only.