Savings and investments

Understanding your investment statement

You receive two investment statements each year: a mid-year statement and an annual statement. They contain the same information but for different periods (from January 1 to June 30, and from January 1 to December 31).

We know there is a lot of information to decipher in this type of statement. We created a help page to explain it all in detail.

What section of your statement would you like to understand better?

Your information

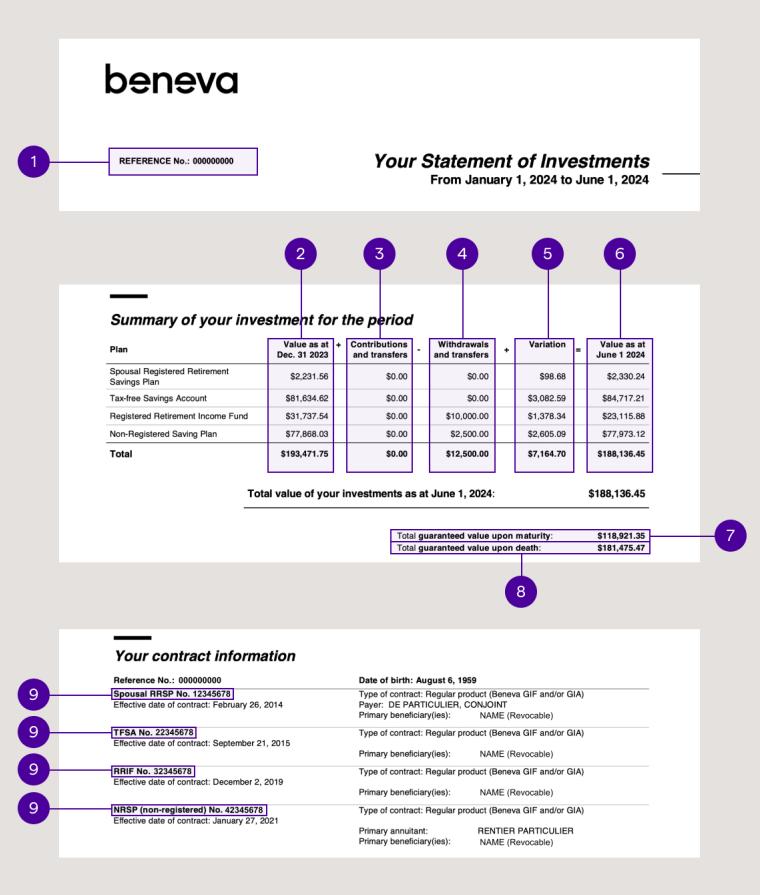

1. Reference No.: your user ID. You’ll need it handy for all communications about your investments and for requests to post your product(s) in the Client Centre.

Whether you have an RRSP, TFSA, RRIF, LIRA or any other savings plan, this table shows your total funds invested and rates of return.

2. Value as at December 31 of the previous year: the total value of your investments at the end of the previous year.

3. Contributions and transfers: the total funds you’ve invested over the investment statement period.

4. Withdrawls and transfers: the total funds you've withdrawn or transferred over the investment statement period.

5. Variation: the return on your investments based on accumulated interest and market variations.

6. Value as at the investment statement date: the value of the total funds you’ve invested since your first contribution and its growth on the investment statement date.

7. Total guaranteed value upon maturity: the value of your investments protected by the guarantee at the maturity of your contract.

8. Total guaranteed value upon death: the value of your investments protected by the guaranteed death benefit.

Find details of your guarantee option, guaranteed amounts and maturity date for each of your plans in the Your guarantees section of the statement.

Find the key information in your contract here, including a comprehensive overview of your investments and beneficiaries.

9. Membership No.: this number identifies each of your active plans.

Your investments

This section displays all your investments, detailed by product and by plan.

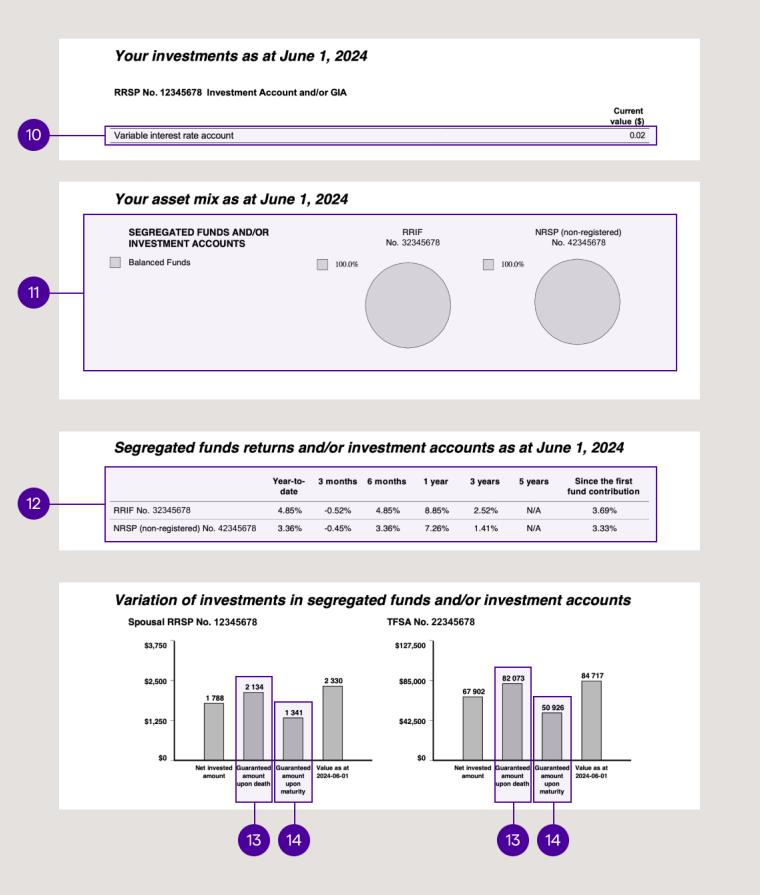

10. Variable interest rate account: a type of investment generally used as a transition for your funds, while waiting for your investment instructions. It generates daily interest, paid each month.

11. Graph: shows what’s currently in your portfolio, the investment mix of your products, whether they are guaranteed investments, segregated funds or investment accounts.

12. Personal rates of return table: shows rate of return percentages for each of your plans, except GIAs, since your first contribution.

Here, you can compare the value of your investment to the total funds you’ve invested, as well as guaranteed death benefits and maturity amounts.

13. Current total of your death benefits: the value of your investments protected by the guaranteed death benefit.

14. Guaranteed amount upon maturity: the value of your investments protected by the guarantee at the maturity of your contract.

Your guarantees

Review how your money is protected against market variations. Find specific details of each investment product in the Notes section of your statement.

15. Guaranteed amount upon death: the value of your investments protected by the guaranteed death benefit.

16. Maturity date: the date your contract ends.

17. Guaranteed amount upon maturity: the value of your investments protected by the guarantee at the maturity of your contract.

18. Current value: the value of the funds you’ve invested since your first contribution and its growth on the investment statement date.

Your transactions

This is where each amount invested or withdrawn from your investments is listed, along with the transaction date.